how to calculate tax on uber income

In relation to providing transportation services to riders. Your average tax rate is 1872 and your.

How To File Your Uber Driver Tax With Or Without 1099

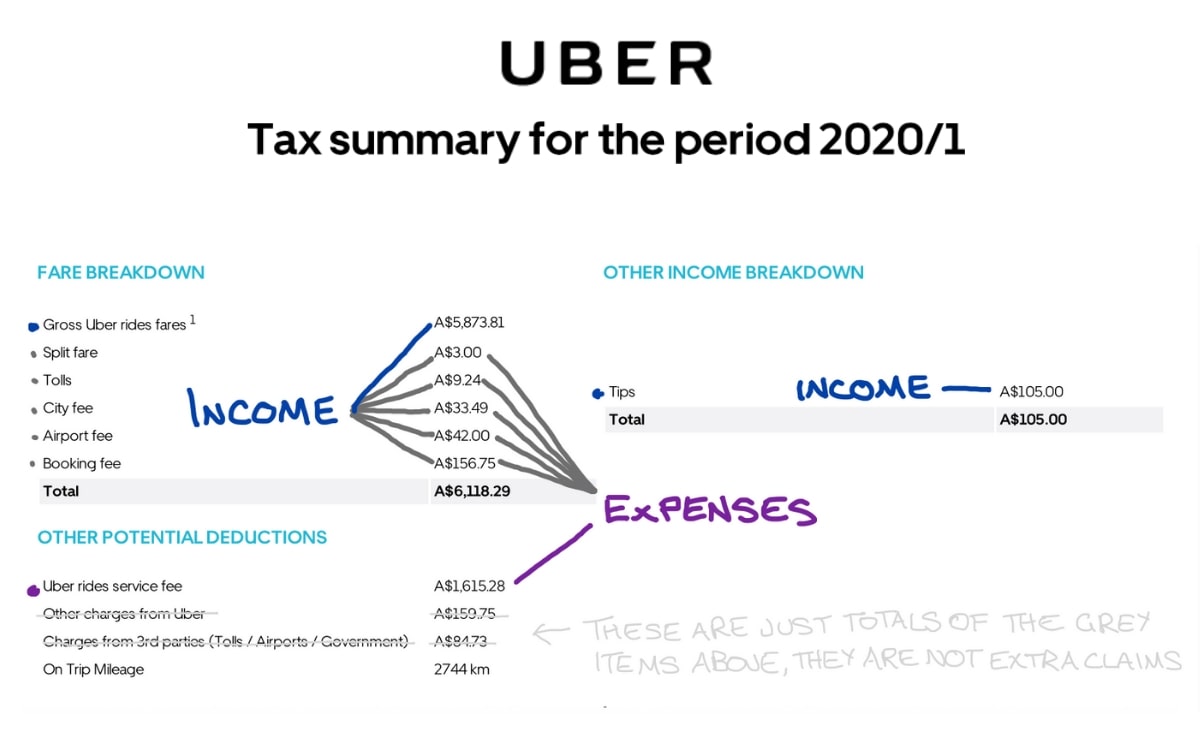

Youll use Schedule C to list your income and expenses and expenses write-offs.

. If you make 170142 a year living in the region of North Carolina USA you will be taxed 40211. This is just a simple calculator to see an estimate of your taxes with standard deductions. The above rates include the Medicare Levy Each time you get paid from driving put that percentage aside.

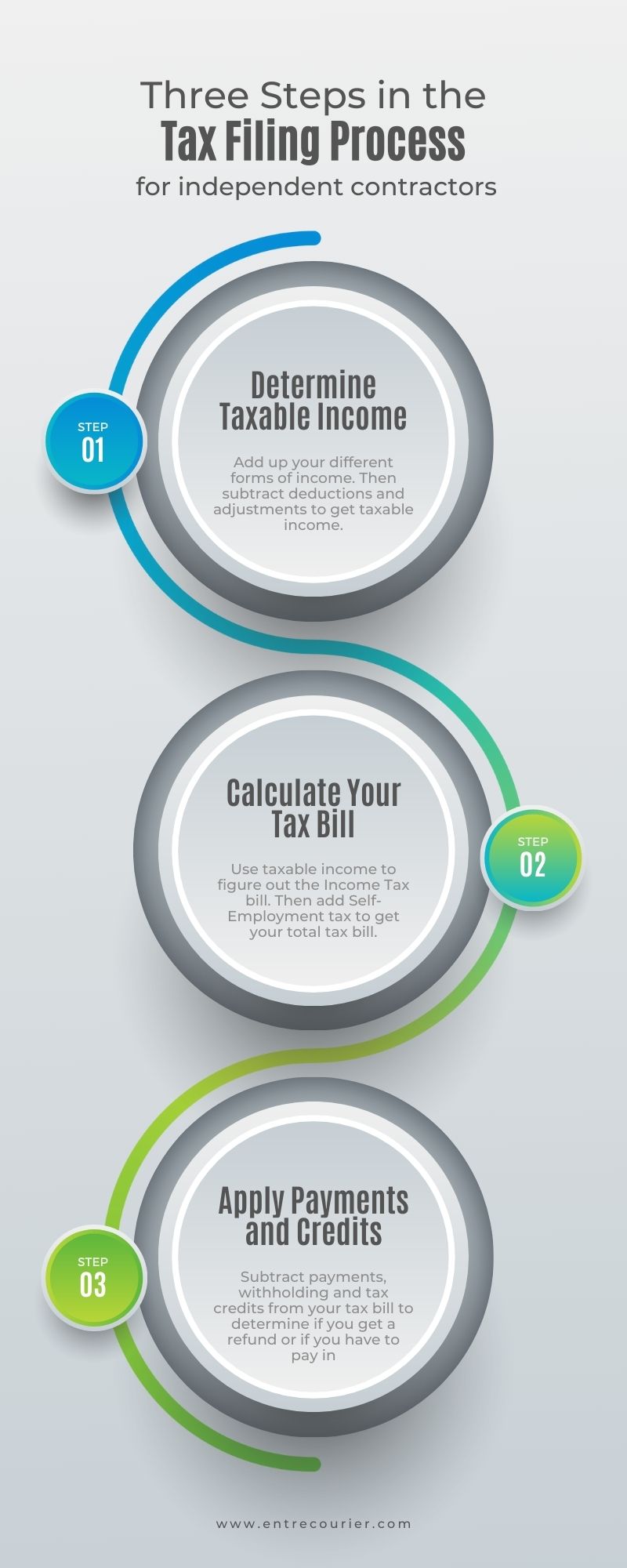

In subtracting your business expenses from your income you put the differences known as business income or loss on line 3 of Schedule 1 for Form 1040. Deduct your rideshare expenses. You start out by adding up your.

Calculate your gross income from rideshare driving. Your tax savings will grow and at the end of each. In New Zealand you may need to register for GST if your turnover exceeds or is expected to exceed 60000 in a 12 month period.

On this form you list all your business income and deductible expenses. Youll report income through the standard tax return Form 1040. North Carolina Income Tax Calculator 2021.

For example if your taxable income after deductions is 35000 you will. If your annual income is over 18000 and less 37000 then the tax rate is 19 and you can get 675 1-19 54675. We are temporary facing.

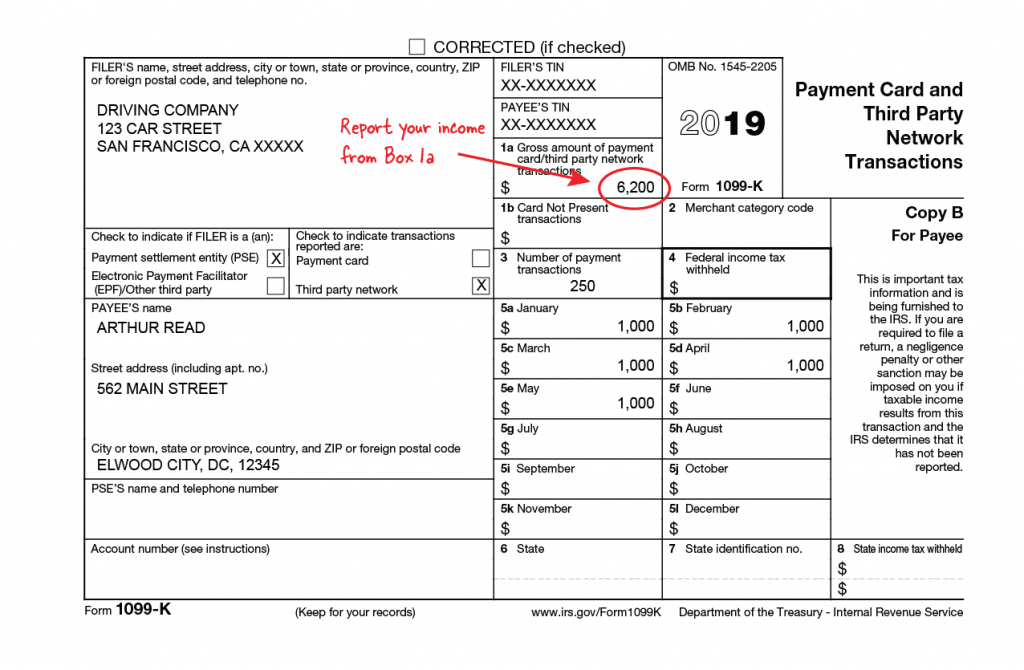

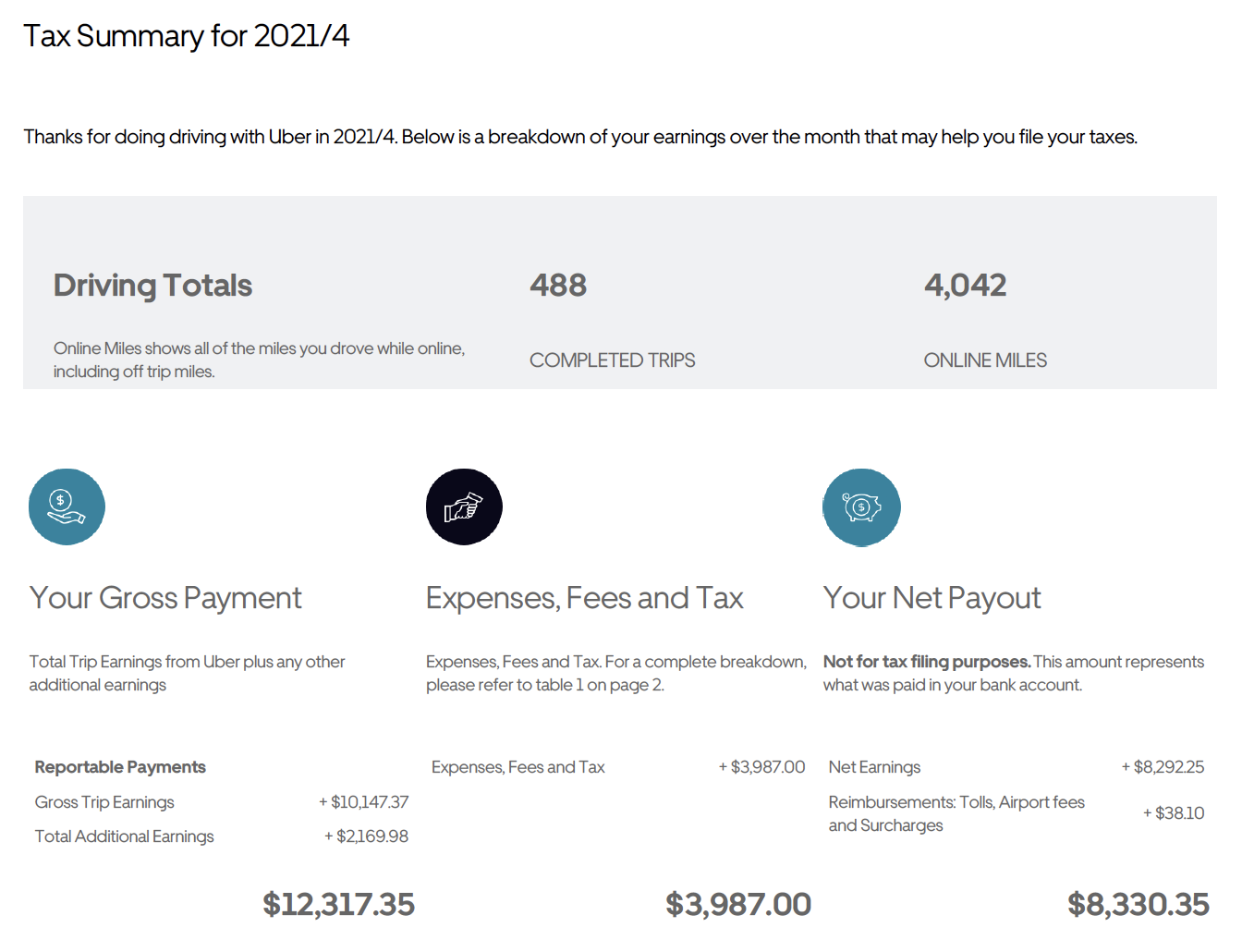

You may receive two 1099 forms from Uber or Lyft but not always. The ATOs Uber tax implications are straight-forward at a basic level. Your annual Tax Summary should be available around mid-July.

The tax summary provides a. Even if you earn. You can find tax information on your Uber profile well provide you with a monthly and annual Tax Summary.

UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income. Medicare and Social Security. If your annual income is over 37000 then the tax.

You only pay tax on the profit you have left after you subtract all your expenses from your business income. What the tax impact calculator is going to do is follow these six steps. Im not a tax expert or a professional CPA.

Use business income to figure out your self-employment tax Add other income you received wages investments etc to figure out total income Subtract deductions and. Any money you make driving for Uber counts as income meaning you must declare it on your Tax return.

Uber Tax Forms What You Need To File Shared Economy Tax

How Do Uber And Lyft Drivers Count Income Get It Back

Drive For Uber Deliver For Amazon Here Are Tax Rules To Know

Tax Tips For Uber Lyft And Other Car Sharing Drivers Turbotax Tax Tips Videos

Can You Claim Tax Back On The Nsw Government Levy Uber Drivers Forum

Uber Tax Information Essential Tax Forms Documents

Tax Tips For Rideshare Drivers Tax Guide For Lyft Uber Drivers

Uber Tax Information Essential Tax Forms Documents

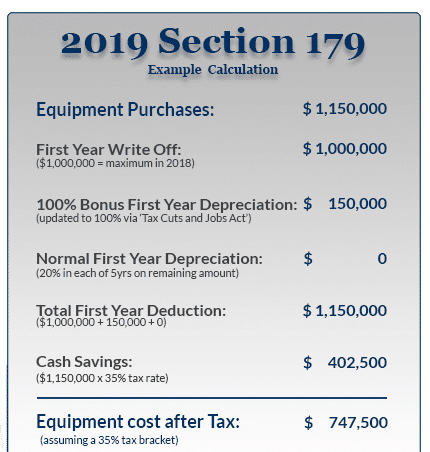

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

9 Ways To Keep More Of Your Money As A Rideshare Driver This Tax Season

How To File Your Uber Driver Tax With Or Without 1099

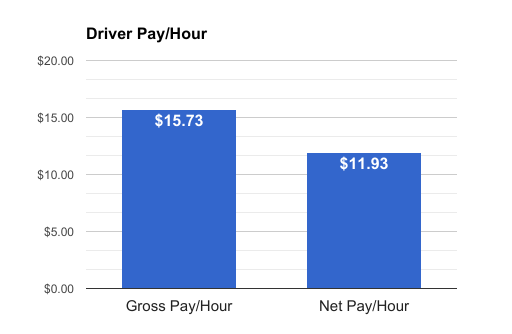

Survey Data Shows How Much Uber Drivers Really Make Income Report Ridesharing Driver

How To File Your Taxes For Uber Lyft And Other Popular Gig Apps

Uber S Elaborate Tax Scheme Explained Fortune

25 Rideshare Tax Deductions Uber And Lyft Drivers Can Use In 2018 Six Figure Drivers

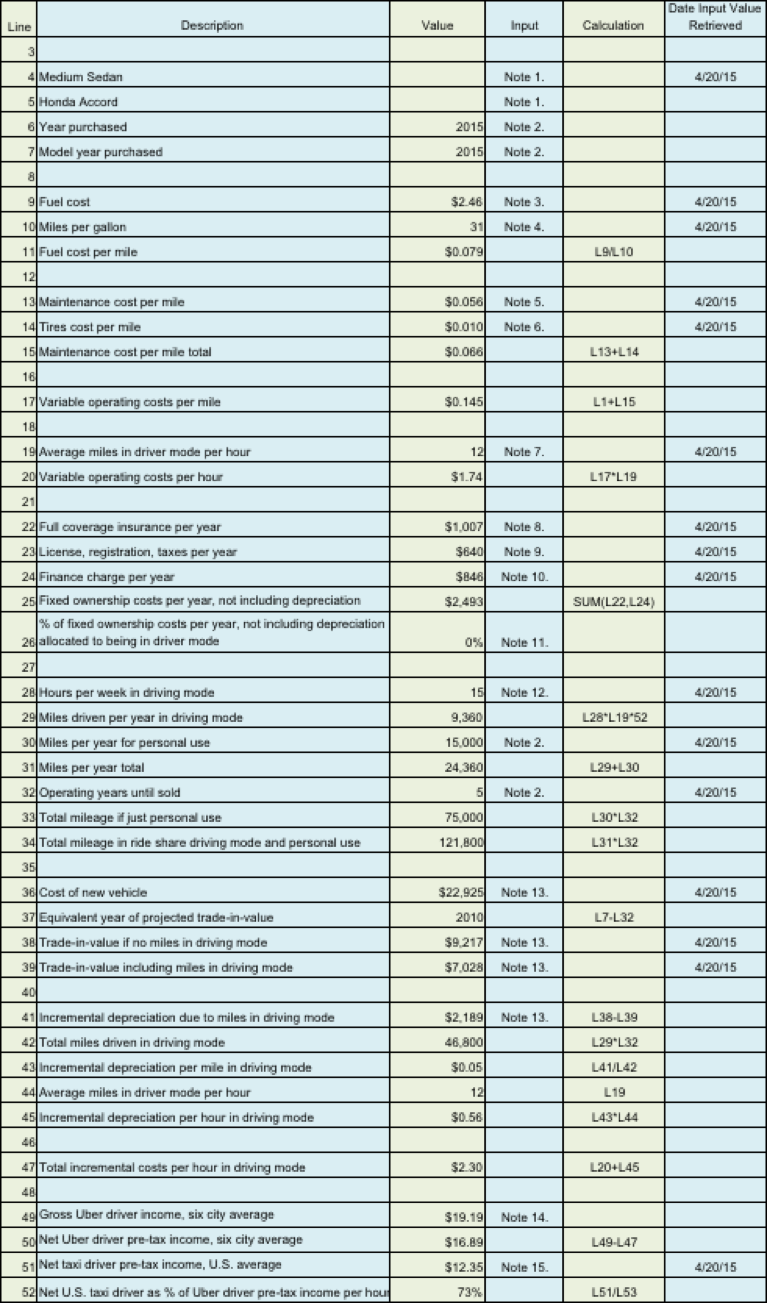

The Impact On Medallion Financial Of Uber Driver Pay Nasdaq Mfin Seeking Alpha

How Uber S Tax Calculation May Have Cost Drivers Hundreds Of Millions The New York Times

How Much Do Uber Drivers Make Pay Salary Review

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income